Understanding Health Insurance

One of the most important investments we can make is having health insurance. Problems like illnesses, injuries and any other medical setbacks can be significantly expensive if they necessitate visits to the hospital and procedures such as surgery. Maintaining adequate health coverage is the best method to ensure that you do not feel hampered when you need to attend emergency medical expenses by yourself.

According to reports provided by the Kaiser Family Foundation, approximately 47 million or 15% of the population of the nonelderly were not insured by the year 2012. As such, these people had to pay 33% of their medical expenses by themselves. They also encountered higher bills than the people who had health coverage. Information from hospitals shows that residential treatment can cost as much as $10,000 per visit.

According to reports provided by the Kaiser Family Foundation, approximately 47 million or 15% of the population of the nonelderly were not insured by the year 2012. As such, these people had to pay 33% of their medical expenses by themselves. They also encountered higher bills than the people who had health coverage. Information from hospitals shows that residential treatment can cost as much as $10,000 per visit.

If you do not want to bear these expenses, you will need to invest in health insurance and do so appropriately. In this article, we are trying to give you some of the fundamental concepts which govern the medical insurance industry and some popular sources of health coverage. Our objective is to ease your burden while educating you about the options available options.

The Basics

When you decide to purchase a cost-effective health insurance coverage, you must understand the terminologies that are used in the industry. This is one of the initial steps that will prove helpful in obtaining a cost-effective coverage plan. Let us begin by giving you a few key definitions.

Premium.

Premium.

This is the amount that you are required to pay the insurance company for the coverage every month or year.

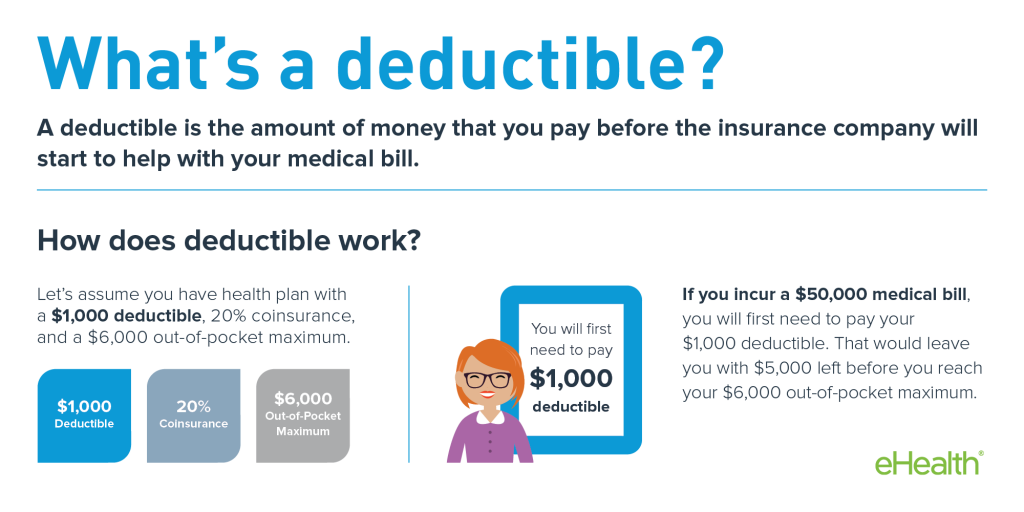

Deductible.

Deductible.

This is the fee you must pay from your pocket before the coverage begins. The amounts are generally rounded off at figures of $500 or $1000. Usually, the lower the premium, the higher the deductible.

This is the fee you must pay from your pocket before the coverage begins. The amounts are generally rounded off at figures of $500 or $1000. Usually, the lower the premium, the higher the deductible.

Coinsurance.

Coinsurance.

This is the money that will be owed to the medical provider after the deductible is paid. Coinsurance is typically set as a percentage of the entire bill.

Co-pay.

Co-pay.

This insurance plan is similar to coinsurance with a single exception. You will not be required to wait until the deductible has been paid, but you are required to make a copayment when you receive the service. Copayments are generally standardized by the plan you have chosen.

Out-of-pocket maximum.

Out-of-pocket maximum.

This is the money you pay as deductibles and charges for coinsurance before the insurer begins paying for all expenses that are covered.

In network.

In network.

This term refers to medical establishments and physicians that are providing patient services covered by the insurance plan. These are the most cost-effective options available for policyholders because the insurers have negotiated lower prices with their network providers.

Out-of-network.

Out-of-network.

These are the medical establishments and physicians that are not covered under your insurance plan. Services obtained from out-of-network providers are expensive because the insurer has not negotiated lower prices with them.

Pre-existing conditions.

Pre-existing conditions.

These are any chronic diseases, disabilities or any of the conditions you may have when making the application. Symptoms and ongoing treatments for pre-existing conditions can result in higher premiums being charged by the insurance company.

Waiting period.

Waiting period.

A number of employer-sponsored plans for insurance mandate a waiting period of 90 days before the employees can enroll in their insurance plans.

Enrollment period.

Enrollment period.

This is the period of time during which you can make an application for health insurance or modify the plan you have chosen to include no spouse or children. Policyholders do not have the option of adjusting their plan until the next open enrollment unless they experience events such as marriage, divorce, changes to personal or household income, relocation, the birth of a child, etc.

This is the period of time during which you can make an application for health insurance or modify the plan you have chosen to include no spouse or children. Policyholders do not have the option of adjusting their plan until the next open enrollment unless they experience events such as marriage, divorce, changes to personal or household income, relocation, the birth of a child, etc.

Where Can You Get The Coverage You Need?

Where Can You Get The Coverage You Need?

Within the United States, most health insurance coverage options fall under a couple of general categories. You may purchase individual coverage for yourself and your family members by contacting insurance companies directly. You can also opt for group coverage if you are an eligible employee or a student. The parameters and regulations pertaining to either type of coverages have changed significantly with the introduction of the Affordable Care Act.

More in Motivation

-

`

Coping With Traumatic Stress Reactions – PTSD

Post-Traumatic Stress Disorder (PTSD) is a complex mental health condition that sometimes develops in the aftermath of a traumatic event. It affects...

November 19, 2023 -

`

Is Swimming in Cold Water Good for You?

Swimming is a beloved activity that provides numerous physical and mental health benefits. Swimming can be a fantastic workout, whether you’re...

November 15, 2023 -

`

Unlocking the True Benefits of Detox Water

Detox water has taken the health and wellness world by storm, promising a wide range of benefits that go beyond ordinary...

November 7, 2023 -

`

How Tom Brady Shed 10 lbs After Retirement

One of the NFL’s most celebrated athletes, Tom Brady, has always been a topic of discussion. Brady never fails to surprise,...

November 1, 2023 -

`

AI’s Hidden Toll on Our Brains

Artificial Intelligence (AI) has permeated almost every facet of our lives, from virtual assistants and recommendation algorithms to autonomous vehicles and...

October 24, 2023 -

`

What to Drink During a Workout

When it comes to getting the most out of your workout, proper hydration is key. What you drink during exercise can...

October 17, 2023 -

`

Wearable Technology Applications in Healthcare

The world of healthcare is evolving at an unprecedented pace, and wearable technology is one of the driving forces behind this...

October 10, 2023 -

`

Initiating and Integrating Exercise in Daily Life

Incorporating exercise into our daily lives is essential for maintaining optimal health and well-being. However, initiating a fitness routine and seamlessly...

October 10, 2023 -

`

Jason Momoa’s Workout Routine for Iconic Aquaman Look

We all remember the moment: The big screen lights up, waves crash, and out emerges Jason Momoa as Aquaman, with his...

October 8, 2023

You must be logged in to post a comment Login