Types of Health Care Fraud You Need to Avoid At All Costs

As a working adult, we all acknowledge the importance of having a healthcare insurance system. The amount of stress and pressure we’re dealing every single day, as well as eating unhealthy food, slowly degrades our health and well-being. What’s worse is that we often don’t even know or pay enough attention to the damage we’ve inflicted to our body until it’s too late. We only realize how dire the situation is when we’re finally admitted to the hospital and that can be just the tip of the iceberg. Nonetheless, while we’re nursing our weak body back to health, we often also deal with paying hefty amounts of hospital bills that deplete our hard-earned savings.

That’s why we always recommend staying in shape and implementing a healthy lifestyle. It’s the best method to prevent illness but it’s really difficult to live a healthy lifestyle, though, and it’s best to acquire a good health insurance. That way, if your body starts malfunctioning and you’re incapacitated to perform tasks well, at least you can still afford to heal yourself without draining your pocket. Your health insurance will help pay your hospital bills in emergency cases or if accidents happen.

Before you go and sign that health insurance policy, you might want to reassess its coverage policy first. There are some insurance companies that are only interested in increasing their bank accounts rather than delivering the services you need so we are now listing the types of health care frauds most insurance companies include in your policy that should actually be avoided at all cost.

Billing for Services They Don’t Render

Medical bill and health insurance claim form

Most of the health care fraud insurance cases have submitted forms to the government about the insurance coverage and services they cater but in reality, it was never provided to their customers. It also doesn’t correspond to the patient’s file and no supporting documentation attached signified that the patient had used the services indicated in the coverage. Of course, most hospital institutions take into consideration that some documents may have indeed been replaced. But for most cases, especially when it comes to frauds, they will throw in extra dates, codes, and even services just to trick you into thinking that your health insurance looks promising. When in reality, it isn’t and you’re often paying for nothing.

Billing for the Non-Covered Services And Labelling It As Covered

Allergy Doctor Conducting Allergy Experimental Treatment

One notable example of this type of fraud is when an allergy doctor is conducting an experimental treatment. Usually, these types of treatments are not approved by most government health care plans or companies. However, some companies and even medical practitioners would label this experimental treatment as something else that is covered by your insurance plans, entitling you to pay more for these “covered” services when in fact, it isn’t covered. Before you sign any health insurance policy, you should check individual services first and familiarize yourself to know the scope and coverage of your health insurance.

Misrepresenting Dates of Services

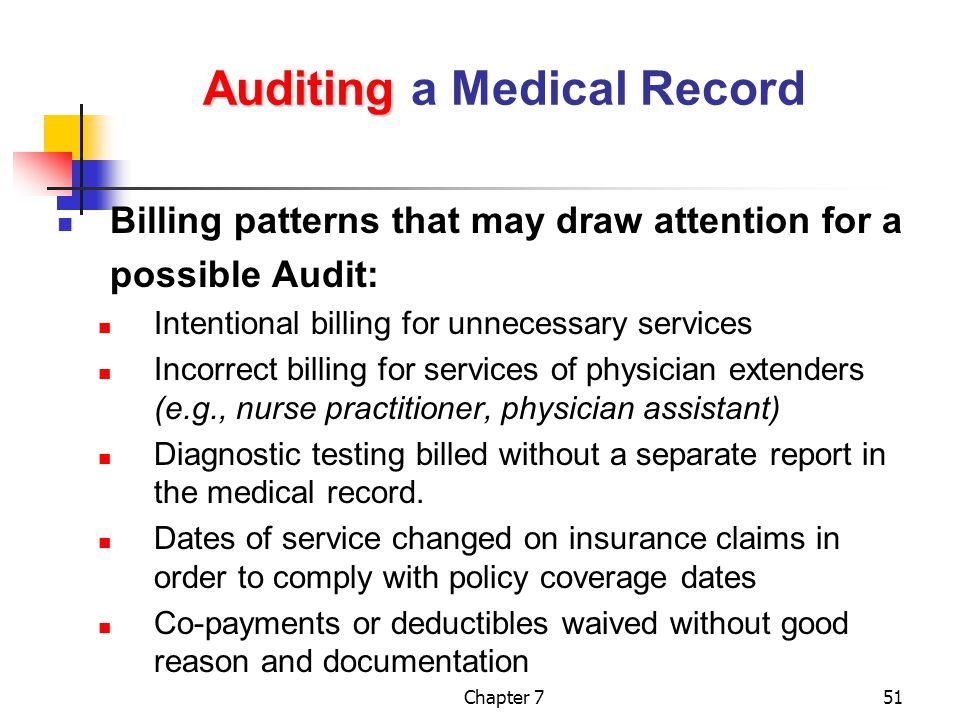

Tips to Audit a Medical Record

Healthcare insurance providers make more money by misreporting the dates of check up with their patients. Instead of indicating that they have visited and treated the same patient for only one day, they will indicate two days or more just to take more money. Why? It’s because every medical appointment conducted is a billable service, burdening the customers to pay more for redundant service. It’s important that you first check your medical file (that’s why it’s important to have supporting documents, as well) and match it with the dates indicated in the claim forms to determine whether your provider is telling the truth or not. We recommend you to focus on the date of actual service and the date the claim form was signed to match your documents.

Misrepresenting Providers of Services

Fake Medical Practitioner Conducting Checkups

It’s scary enough when you encounter people imposing as medical practitioners but these cases happen. If not, maybe you encounter a medical practitioner but not a licensed or registered one. Often, these fake medical providers would sign insurance claim forms and when they do, they get paid for the services they didn’t render legally while the affected insurance company (and even you as the customer) would be left paying for the “care provided”. In order to ensure that you’re only receiving the best and legal treatment, it’s recommended that you go into registered hospital institutions. You and your insurance provider might pay a few more pennies in the process but, at least, you’ll be safe and sound.

More in Motivation

-

`

6 of the Richest Female Rappers in the World

Who is the richest female rapper in 2024? Well, the hip-hop world has seen a surge in powerful female voices who...

July 29, 2024 -

`

Does Insurance Cover Physical Therapy?

When it comes to physical therapy, a common question arises: Do you use health insurance for physical therapy? Well, navigating the...

July 25, 2024 -

`

Does Coughing Work Your Abs? Here’s All You Ought to Know

When it comes to unexpected ways to engage your core, you might find yourself asking: Does coughing work your abs? The...

July 19, 2024 -

`

How to Prepare Rice Water for Weight Loss – Benefits and Uses

Rice water isn’t just a staple in traditional remedies—it’s a powerhouse of benefits for health and beauty. From treating diarrhea to...

July 12, 2024 -

`

Amanda Bynes Pregnant at 13? Debunking the Rumors

In recent years, the internet has been ablaze with rumors surrounding former child star Amanda Bynes, particularly regarding allegations of a...

July 1, 2024 -

`

Can Baking Soda Clean Your Lungs?

Years of inhaling cigarette smoke, pollution, and other toxins can leave you longing for a way to cleanse your lungs. The...

June 27, 2024 -

`

How to Build Muscle Mass After 60? 5 Proven Strategies

Curious about how to build muscle mass after 60? You are not alone. And the good news is that it is...

June 20, 2024 -

`

Prediabetic Foods That Can Lower Your Blood Sugar in 2024

Prediabetes is a health condition characterized by blood sugar levels that are higher than normal but not high enough to be...

June 13, 2024 -

`

Kelly Clarkson’s Weight Loss Journey | Here Are the Details

Kelly Clarkson’s weight loss has been a hot topic among fans and media alike. The iconic American singer and host of...

June 3, 2024

You must be logged in to post a comment Login